Tracking Uber stock on FintechZoom changed how I invest. The detailed analysis and real-time alerts helped me buy at the right time and make more money. It’s made my path to growing my finances much easier.

“FintechZoom Uber Stock” means the information and analysis about Uber’s stock on FintechZoom, a website that shares news about financial technology. It helps investors understand how Uber’s stock is doing, the company’s financial health, and if it might be a good investment.

This guide covers “FintechZoom Uber Stock.” We’ll talk about how Uber’s stock is doing, market trends, and the company’s financial health.

What is FintechZoom?

FintechZoom is a website that shares news and information about financial technology. This includes topics like cryptocurrencies, stock markets, and new financial services. It’s a place where people can read about the latest trends and changes in the world of finance.

For investors and anyone interested in finance, FintechZoom is very helpful. It offers detailed articles and analysis to help people make smart investment decisions.

Whether you want to know about a specific stock or understand how new technology is changing finance, FintechZoom has the information you need.

Why Focus On Uber Stock?

Focusing on Uber stock is important because Uber is a big company in the ride-sharing and food delivery businesses. Many people use Uber for rides and food delivery, making it a popular and influential company.

By looking at how Uber’s stock is doing, we can understand more about the company’s success and future potential.

Investing in Uber stock can be a good opportunity because the company is always growing and trying new things, like self-driving cars and delivery services.

Knowing more about Uber’s stock helps investors decide if it’s a good investment and how it fits into their overall financial plans.

Read: China Seo Xiaoyan – The Dynamic Chinese Digital Market!

What Defines Uber Technologies Inc.’s Business Model And Market Strategy?

History and Evolution:

Uber was founded in 2009 in San Francisco, California. It started as a ride-sharing service and quickly expanded its operations globally. Over the years, Uber has diversified its services to include food delivery (Uber Eats), freight transportation (Uber Freight), and even autonomous driving research.

Business Model and Revenue Streams:

Uber operates on a platform business model, connecting drivers with passengers through its app. Its revenue streams include:

- Ride-sharing: Fees from rides booked through the app.

- Food delivery: Commissions from food orders via Uber Eats.

- Freight: Fees from freight services.

- Advanced Technologies Group (ATG): Investments in autonomous driving technology.

Market Position:

Uber is a market leader in the ride-sharing industry, competing with companies like Lyft in the United States and Didi in China. In the food delivery sector, it competes with services like DoorDash and Grubhub.

What is the Financial Performance of Fintechzoom Uber Stock Uber?

Quarterly Earnings Reports:

Uber’s financial performance is detailed in its quarterly earnings reports. These reports provide insights into the company’s revenue, expenses, net income, and other financial metrics. Analyzing these reports helps investors understand the company’s financial health and future prospects.

Key Financial Metrics:

- Revenue: Total income from all business segments.

- Net Income: Profit after all expenses have been deducted.

- Earnings Per Share (EPS): Net income divided by the number of outstanding shares.

- Gross Bookings: Total dollar value, including taxes, tolls, and fees, of all rides and food deliveries.

Recent Financial Performance:

In recent quarters, Uber has shown growth in its food delivery segment, partly driven by the COVID-19 pandemic, which increased demand for home delivery services. However, the ride-sharing segment faced challenges due to lockdowns and travel restrictions.

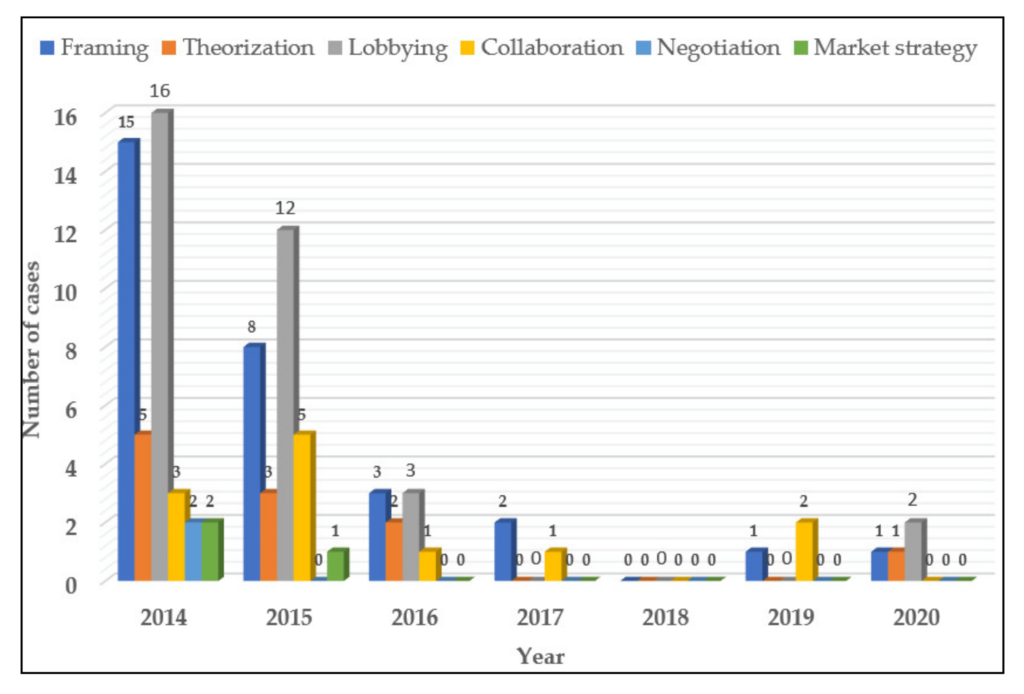

What Factors Are Considered In Uber’s Market Analysis Strategy?

Stock Price Trends:

Uber’s stock price has experienced volatility, influenced by various factors such as market conditions, company performance, and industry trends. Monitoring these trends can provide insights into potential investment opportunities.

Factors Influencing Uber’s Stock Price:

- Market Sentiment: Investor perceptions and broader market trends.

- Company Performance: Quarterly earnings and business growth.

- Regulatory Environment: Laws and regulations affecting the ride-sharing and food delivery industries.

- Competition: Actions by competitors like Lyft, DoorDash, and others.

Future Prospects:

Uber’s future prospects are influenced by its ability to innovate and expand its services. The company’s investments in autonomous driving and international expansion are key areas to watch.

Read: Miguel Gallego Arámbula age – Learn More About Miguel’s Upbringing!

What factors contribute to Uber’s dominance in the ride-sharing industry?

Fintechzoom Uber Stock Uber has firmly established itself as a leader in the ride-sharing industry. Since its inception in 2009, Uber has expanded its operations to hundreds of cities worldwide, offering a convenient alternative to traditional taxi services.

The company’s innovative app connects drivers with passengers seamlessly, providing real-time tracking, easy payments, and user reviews to enhance the customer experience.

This dominance in the ride-sharing market has allowed Uber to create a strong brand presence and loyal customer base, positioning itself as a go-to service for urban transportation.

However, maintaining this dominance requires continuous innovation and adaptation. Uber faces stiff competition from local and international rivals like Lyft and Didi. To stay ahead, Uber invests heavily in technology, including autonomous driving research and electric vehicle integration.

What is Fintechzoom Uber Stock Uber’s approach to food delivery services through Uber Eats?

UberEats has become a significant player in the food delivery market, complementing Uber’s core ride-sharing business. Launched in 2014, Uber Eats connects customers with local restaurants, providing a platform for convenient food delivery.

The service has seen tremendous growth, especially during the COVID-19 pandemic, as more people opted for home delivery over dining out.

Uber Eats’ extensive network and efficient delivery system have made it a preferred choice for both consumers and restaurant partners, boosting its market share in the competitive food delivery industry.

The success of Uber Eats is driven by continuous innovation and strategic partnerships. Uber regularly enhances the app’s functionality, introducing features like contactless delivery and real-time order tracking to improve the customer experience.

What Are Uber’s Strengths, Weaknesses, Opportunities, And Threats?

Strengths:

- Market Leader: Dominant position in the ride-sharing industry.

- Brand Recognition: Strong global brand presence.

- Diversified Services: Multiple revenue streams beyond ride-sharing.

Weaknesses:

- Regulatory Challenges: Facing legal and regulatory hurdles in various markets.

- High Operating Costs: Significant expenses related to driver incentives and technology investments.

Opportunities:

- Expansion into New Markets: Potential for growth in emerging markets.

- Autonomous Vehicles: Long-term benefits from investment in self-driving technology.

- Increased Demand for Delivery Services: Growth potential in the food delivery segment.

Threats:

- Intense Competition: Rival companies in both ride-sharing and food delivery.

- Economic Downturns: Reduced demand during economic recessions.

- Regulatory Risks: Changes in laws and regulations that could impact operations.

Read: Sigmond Galloway – Exploring The Legendary Knight’s Tales!

FAQs:

1. What Is The Current Price Of Fintechzoom Uber Stock?

The current price of Uber stock fluctuates based on market conditions. For the latest price, check financial news platforms like FintechZoom.

2. Is Fintechzoom Uber Stock A Good Investment?

Investing in Uber depends on various factors including market trends, company performance, and your own risk tolerance. Analyzing financial reports and market conditions can help in making an informed decision.

3. How Does Fintechzoom Uber Stock Make Money?

Uber generates revenue from ride-sharing, food delivery (Uber Eats), freight services, and investments in autonomous driving technology.

4. What Are The Risks Of Investing In Uber?

Risks include regulatory challenges, high operating costs, intense competition, and economic downturns. Understanding these risks is crucial for potential investors.

5. How Can I Buy Fintechzoom Uber Stock?

You can buy Uber stock through a brokerage account. Simply search for Uber Technologies Inc. (NYSE: UBER) and place an order through your broker.

Conclusion:

Fintechzoom Uber Stock has become a leader in ride-sharing since it started in 2009. Despite competition from Lyft and Didi, Uber keeps growing worldwide with new technologies like Uber Pool and Uber Health. By focusing on making travel easier and adapting to what customers need, Uber stays strong in cities around the world.

Read more: